Lebanon’s bloated government sector and currency hyperinflation are prime examples of why bitcoin has a use case in the destabilized country.

Thomas Semaan is a finance and economics enthusiast. He launched an Arabic speaking podcast about Bitcoin, economics and Lebanon. Thomas is also an active member of the Lebanese and Arab Bitcoin community.

Behind the destroyed, unlit roads and the emptiness of its downtown, Beirut has huge skyscrapers that play the role of the headquarters of Lebanon’s local banks. The tale of the Lebanese successful banking reputation dates back to the inception of the Lebanese state in 1943. You can pinpoint the success of this sector to many different aspects, including but not limited to the central bank’s once-strict monetary policy, the acquisition of huge amounts of gold in the 20th century making Lebanon the third-largest holder of gold per capita in the world and number one in the middle east and north of Africa, or the banking secrecy law that imitate the Swiss banking sector which attracted many wealthy individuals and corporations to leverage it. Also, under the often seemingly under-developed aspects of the country, lies a huge public sector, one that gives the impression to be all about productivity and services, but is actually welfarist in essence.

Prior to 2020, two types of jobs were considered lucrative for the average Lebanese citizen: working in banking or working in the government. Working in banking meant that you are essentially part of a too-big-to-fail industry, while working in the government meant that you get to earn an above average salary, more than regular benefits and end of services indemnity with barely any effort or skills and guaranteed by law that you will never be fired from your position. All this was possible thanks to a third contributor to the formula, the financier of the Lebanese banking sector.

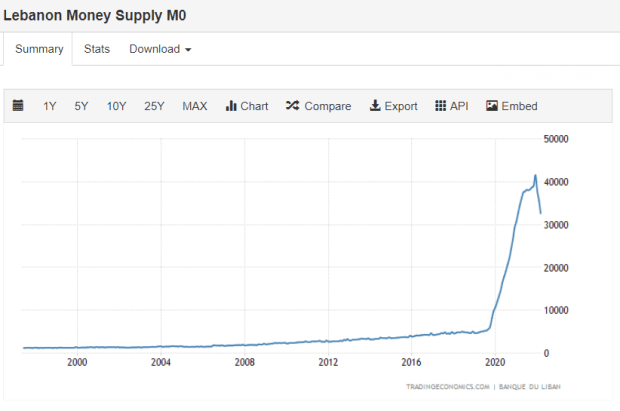

For the reasons mentioned above, the Lebanese banking sector was attractive to many investors and was only relevant for a certain period of time. One could say from the time of the country’s civil war (lasting from 1975-1990), most of these reasons ceased to be relevant, especially with the world moving away from a gold standard and with banking secrecy no longer being secret, practically. By the early 2000s up until the late 2010s, the investors in the banking sector, known as depositors, were lured by high interest rates, only made possible through banks buying even higher interest-bearing government bonds. In simple words, the formula went as follows: The government sold high-interest bonds to local banks through the central bank, the banks were able to afford and compete over who could bait more investors by selling them high interest rate deposits. The depositors were happy to take part of this scheme as long as they were getting paid the hefty amounts on time. While interest rates around the world were zero or close to zero, the Lebanese depositor was enjoying a whopping 10-15% on their deposits. As you may have guessed already, and similar to many shitcoin staking projects, this system was bound to collapse — and it did. In late 2019, it had been quasi-settled that depositors will not get their full balances anymore. Because the government was essentially non-productive and incapable of paying back the banks, the banks in turn were not able to pay back their customers. With this impending reality, the central bank started printing money and paying back the depositors accordingly, which caused the infamous hyperinflation in Lebanon. The Lebanese pound lost around 90% of its price against the U.S. dollar. In late 2019, $1 equaled 1,500 Lebanese pounds. At the time of writing, $1 equals 35,000 Lebanese pounds.

Lebanon is characterized by horrible infrastructure: horrible roads, horrible electricity infrastructure, even horrible communication lines and internet. All of these sectors are controlled by the government. On top of that, the Lebanese government employs over 300,000 people in the public sector. For a country that has around three to four million adults who are eligible for work, the government is essentially employing around 10% of the entire workforce of the nation. This is huge for any country, not to mention a country that claims to adopt free market and capitalist principles. For a long time Lebanon was considered a Libertarian utopia compared to its neighboring region, while in fact it’s more like a Libertarian’s nightmare.

Make no mistake, the average Lebanese citizen was not happy with this situation at all. This economic reality of the country could be considered (depending on how you see it) as the cause or the consequence of never-ending political tension in the country. Since the 2000s up until this day, the Lebanese voter always strived for political change. Considering the nature of the country’s demography, this led to many sectarian and regional conflicts. The last 20 years in Lebanon saw many protests, political assassinations, shoot outs, war with neighboring countries and emigration. It all failed for one simple reason: the people were making a political attempt to change the government, while funding it through their local banks at the same time. Not only was a huge chunk of the country’s capital being funneled into an obvious Ponzi scheme, but this capital was also used for the most inefficient government-controlled economy. When the government collapsed and was no longer able to pay back its obligations, it lost its major funding source. Everything that the government used to control has completely collapsed with it. Since the official energy grid in Lebanon has collapsed, individuals are finding alternative sources of energy.

Here’s the catch, the average depositor in Lebanese banks did not have the intention to fund the government. Almost everyone knew the government was inefficient and there is a general culture of distrust in the government. However, depositors were simply lured into a high interest rate deal, which seemed to be working for over a decade. Now that this scheme has completely collapsed, and the need for the Lebanese citizen to have an alternative saving mechanism is still there, the short and clear answer for this problem is and will always be bitcoin.

Even though bitcoin doesn’t care to lure an investor in and make promises about future gains, its record speaks for itself. My Bitcoiner friend who also happened to be Lebanese, Hass McCook, ran the numbers. With a conservative monetary policy of 21 million coins to ever exist, using this technology as a saving tool is not at all a bad idea; it could be the only good idea. It is true that Bitcoin offers peer-to-peer, borderless settlement around the world, which could also be considered beneficial for the average Lebanese citizen with a currently disabled banking sector, but it is the lack of saving problem that manipulated investors and led to the collapse of the economy as a whole.

When money was deposited in the banking sector, it was being used to fund the government in the background. Comparatively, money that goes into bitcoin is funding an open-source, truthful, decentralized and trustless network of independent users who are incentivized to be honest — from miners to full nodes to regular users. Above all else, the Lebanese citizen can ultimately escape being coerced to fund a corrupt government and in turn, directly benefit from funding a system that promotes peace and the sovereignty of the individual.

This is a guest post by Thomas Semaan. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.